- First Mover Market Advantage

- Posts

- ed

ed

The best trades happen before the chart even moves.

Price tells you what happened. Pressure tells you what's about to happen.

Ghost Prints™ is the only surveillance-grade console built to detect institutional movement before it breaks the chart.

SILJ: +392%. ET: +221%. KWEB: +141%.

This is how you trade with clarity — not guesswork.

Smart Money Calling Powell’s Hawkish Bluff

By Brandon Chapman, CMT

feared. Fewer rate cuts ahead. Hawkish words.

The market's response? Buyers flooded in. The SPX pushed toward all-time highs. The message was clear: Nobody's buying the Fed's tough talk anymore.

But unimpeded buyers would do well to see what the Ghost Prints Surveillance Console picked up.

There's a problem hiding in that rally. Oil prices also drifted higher into Wednesday's close. That's a direct threat to airline margins.

JETS, the ETF that tracks major airline stocks, has been flying higher. Buyers betting on lower fuel costs and strong consumer demand. If oil keeps climbing, those assumptions collapse.

Higher fuel costs crush airline profitability. Ticket prices rise. Consumers pull back. The entire thesis breaks.

And somebody with serious capital already positioned for exactly that scenario.

What Ghost Prints Caught

Thirty minutes before Powell spoke, a massive bearish position hit the tape.

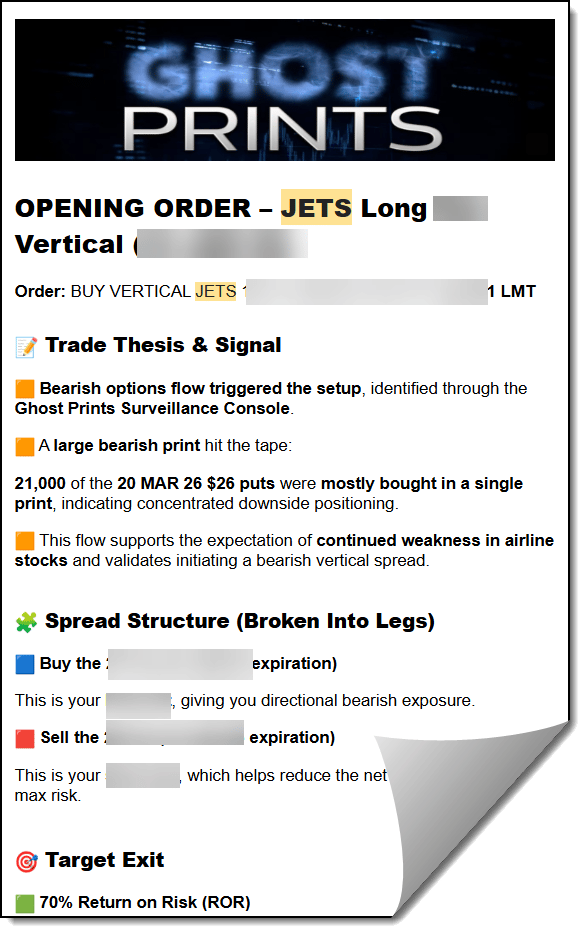

The Ghost Prints Surveillance Console flagged 21,000 puts on JETS. The March 26th strike. Mostly bought in three large prints: 7,000 contracts, then 3,000, then 11,000 more.

This wasn't hedging. This was conviction. Someone dropped serious money betting JETS reverses hard.

The timing matters. This trade went down before the Fed confirmed fewer rate cuts than expected in 2026. Before the market surged. Before oil's close near session highs.

Smart money positioned ahead of the chaos. Not in response to it.

Why JETS Gets Hit Regardless

Three scenarios play out from here. In each one, JETS faces pressure.

Scenario One: The dovish scenario. The Fed eventually caves and cuts more than expected. That sends commodities higher. Oil spikes. Higher fuel costs crush airline margins. JETS drops.

Scenario Two: The hawkish scenario. The Fed holds firm. Risk assets sell off. High-beta names like airlines get hammered first. JETS drops.

Scenario Three: The muddle-through scenario. Nothing changes. The market grinds sideways. JETS has already pushed too far too fast. Mean reversion kicks in. JETS drops.

Every path leads to the same place: JETS coming down.

That is why I put out the following trade alert. To follow the big money and capture a likely pullback.

The Trade Structure

I put together an options spread trade for Ghost Prints members:

While the details are reserved for Ghost Prints Members, I’ll tell you this.

I like spreads because they define my maximum potential loss and reward from the outset.

So, once I’ve got the trade on, I can set my exit order for 70% of maximum profit. It’s not just easier to understand, but requires FAR LESS management.

The Bigger Picture

The Fed can talk hawkish all it wants. The market stopped listening. Dollar weakness drives the bus now. That creates pockets of extreme positioning.

JETS represents one of those pockets. Too far too fast. Vulnerable to reversal in multiple scenarios. Perfect for defined-risk positioning.

Those 21,000 puts didn't materialize by accident. They signal exactly what sophisticated traders expect next.

This trade exposes the risk behind pushing prices higher when fundamental forces create drag.

Right now, risk can be found in high-flying names like JETS.

Now, I know this looks like an amazing trade idea. Yet, this just scratches the surface of what the Ghost Prints Surveillance Console is capable of.

Brandon Chapman, CMT

Creator of Ghost Prints