- First Mover Market Advantage

- Posts

- Weekend ed

Weekend ed

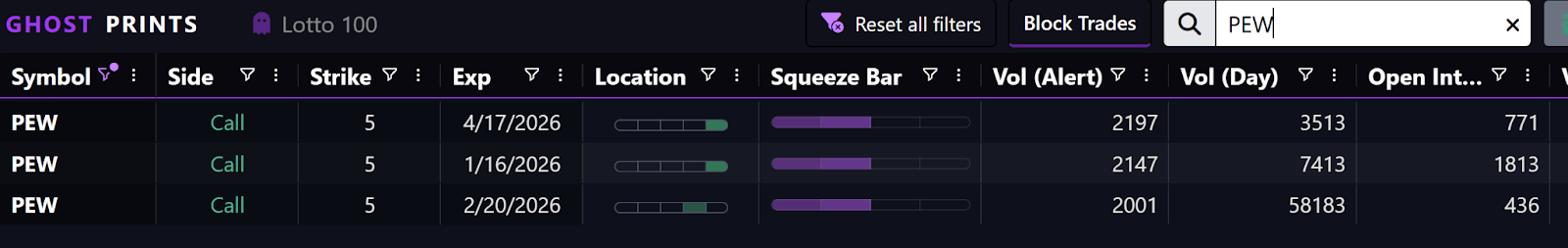

PEW: A Live Squeeze Has Begun

By Brandon Chapman, CMT

Someone just forced market makers to buy millions of dollars in a stock they didn’t want.

The price is already moving big.

You’ll probably read about it tomorrow. But Ghost Prints followers got started today.

If you missed the fireworks, that’s too bad. But the show isn’t over.

Let me help you see what comes next.

When Volume Screams and Nobody's Listening

PEW hit 53,000 call contracts today. That's 1,262 times average volume.

80% filled at the ask price. Virtually zero call sellers anywhere on the tape.

Think about what that means.

When buyers outnumber sellers this dramatically, market makers become the sellers by default.

They sold calls all morning. 53,000 contracts worth. And now they're exposed to massive directional risk.

Market makers don't take bets. They hedge.

When they sell calls, they buy stock to offset delta exposure. The $5 strike traded most actively today with a 35 delta. For every 100 calls sold, market makers bought roughly 3,500 shares.

Do the math. 53,000 contracts equals 5.3 million shares of underlying exposure. At current prices, that's over $16 million in forced stock buying.

This is gamma at work. The more calls retail buys, the more stock market makers must purchase.

That buying pushes the price higher. As price climbs toward the strike, delta increases. More hedging required. More buying pressure. The feedback loop accelerates itself.

The $5 Strike That Changes Everything

The action concentrated at the February $5 calls. Way out of the money at yesterday's close. 63 days until expiration. A 35-delta turning into 40 by midday.

Look at the history. PEW doubled from $10 to $20 in the last major squeeze. Could it go from $3.25 to $6.50? The structure says yes. High call volume forcing mechanical buying. Low liquidity amplifying each move. A setup built for acceleration.

But here's what separates professionals from gamblers. If you buy these $5 calls, you risk 30 to 35 cents per contract. That's the game. You're not buying a conservative position. You're buying a calculated squeeze play with defined risk.

The stock closed the day up after morning consolidation. Option volume stayed elevated. Market makers kept hedging. The gamma squeeze is in motion.

Ghost Prints Caught It Early

The Ghost Prints Console flagged PEW when volume hit 40,000 contracts. Members saw the buy-side aggression, the strike concentration, the hedging implications before price broke out.

This isn't a one-off event. This pattern repeats across markets when the right conditions align. Extreme option volume. Concentrated strikes. Market maker hedging requirements creating mechanical buying.

You either see these setups developing or you chase them after they move.

Join the next Ghost Prints session to learn how to identify gamma squeezes before they print on your chart.

Brandon Chapman, CMT

Creator of Ghost Prints

P.S. Short squeeze trades are not a thing of the past. They are still happening. You need a way to see them before they get started. That’s what the Ghost Prints Surveillance Console offers.